It is no secret that there has been sizable growth in the availability and accessibility of alternative investments over the past decade. They are a phenomenal way to diversify your portfolio and potentially generate higher returns (of course, although early-stage private investing offers the most investment opportunities, it is also very risky).

Based on feedback from our amazing community at Vyzer, many of you are already involved in alternative investing.

Data shows that one of the major alternative asset classes that Vyzerians are investing in, is Private Companies (startups and traditional businesses). You may be investing in them directly, through crowdsourcing platforms, or by way of venture capitalists.

Because one of our strategic goals at Vyzer is to give you, the customer, a 360-degree view of your diverse portfolio, we work hard to stay ahead of trends like these, so that we can support the variations of asset classes and categories of your investments.

We have a full list of features representing our customer’s needs, and we are excited to add them to Vyzer! In an effort to roll them out in the fastest way possible, while still maintaining the highest level of detail, we prioritize the development of these features based on what our customers need most.

Private Company investing is one of the fastest-growing asset classes that our customers are adding to their portfolios—topping our list for feature development.

Now … this user-friendly feature is ready for you!

Vyzer’s new Private Companies asset class feature allows investors to:

Indicate the fund or platform used to invest in the Private Company (i.e. bank, brokerage account, digital platform such as iAngels or OurCrowd, etc.).

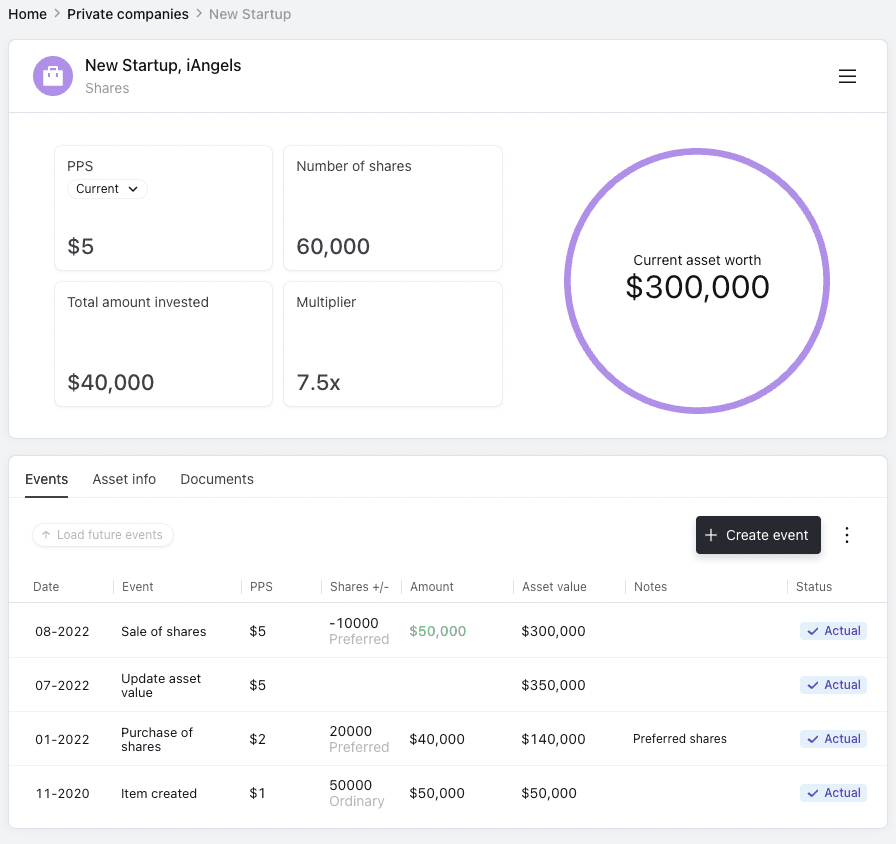

Vyzer’s new feature also provides statistics and metrics on each Private Company investment including:

Remember, as in every Vyzer asset class, creating and updating a Private Company investment can be fully automated via the Vyzer Magic Box (so, you won’t be spending your time manually inputting and maintaining data).

Here is an example of how the Private Companies asset class feature appears in Vyzer:

In addition to the Private Companies asset class feature, we have also recently released the following Vyzer features and upgrades:

Distribution Reinvested (used when the distribution from a pooled investment trust is automatically reinvested in that trust): We added a new type of event to the Managed Funds asset class that allows you to automatically mark your distributions as “reinvested.”

Brokerage Account Breakdown: Vyzer is now retrieving and displaying the specific holdings of your brokerage account from synced institutions, providing deeper insights into the account’s performance.

Redesign of Hero Metrics and Notifications: The new look of these metrics and notifications makes it easier to track your investments.

Events Layout: This new grid view is a lot easier to navigate, displaying all past and future events in a more convenient way.

Loan Section Improvements: A “connected” item is now seen on the liability side of the Loans page, as well on the asset side.

Stay tuned for product upgrades in the Crypto sector. And, finally, remember that you can always submit New Feature requests via the Chat Box at the bottom right of your Vyzer account!

See you soon.

Until then, we will keep working to make Vyzer the best wealth management platform out there!

Lior